Many companies grabbed the opportunity of the government’s PIC (Productivity and Innovation Credit) Scheme. These companies took advantage of PIC to manage manpower shortages from January 2012-November 2013. IRAS (Inland Revenue Authority of Singapore) noted that there were 45000 companies and other businesses that made 63000 claims over two years.

Many companies grabbed the opportunity of the government’s PIC (Productivity and Innovation Credit) Scheme. These companies took advantage of PIC to manage manpower shortages from January 2012-November 2013. IRAS (Inland Revenue Authority of Singapore) noted that there were 45000 companies and other businesses that made 63000 claims over two years.

The number is 30% higher compared to the previous assessment. The 45000 companies or firms mainly invested in staff training and automation. If you are not familiar with the PIC scheme, you can refer to this:

Nature of PIC Scheme

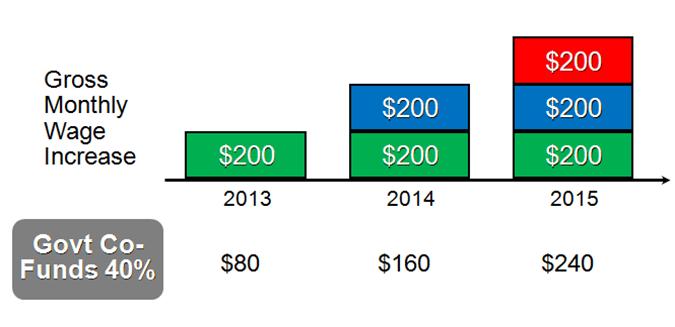

PIC scheme is a government program that gives firms and companies tax deductions and cash payouts if these firms and companies invest in productivity and innovation advancement. PIC can offer your business as much as 400% tax deductions or allowances. That is apart from the 60% cash payout. Tax benefits included in the PIC scheme are offered from YAs (Years of Assessment) 2011-2015. YA 2013-2015 will give your business a PIC bonus.

PIC Qualification

The benefits (like tax deductions, cash payouts and bonus) will be enjoyed if the company or firm qualifies in six activities. Six qualifying activities include acquisition and leasing of PIC IT (Information Technology) and automation equipment, design projects, R&D (Research and Development), employee training, acquisition and in-licensing of IPR (Intellectual Property Rights) and registration (of patents, designs and trademarks).

Claiming PIC

400% tax deductions can be claimed in ITR (Income Tax Return). The Cash payout benefit can be claimed upon submission of PIC cash payout form. The PIC cash payout is only applicable for the PIC IT and automation activity. If you are getting the PIC bonus, you do not need to file a separate claim. You can claim the bonus with your tax deductions and the cash payout.

Filing PIC claims

Filing for PIC claims is trouble-free and easy. Companies or firms should not think that it is complicated. There are business entities that file their own PIC claims. But there are others who consider PIC consultants. PIC consultants are there to lend a hand when companies or firms need to claim their PIC benefits. It is important that your consultants are reliable and trustworthy. You have to make sure that they are certified and knowledgeable about PIC benefits and claims.

Hopefully the things mentioned above enlightened you. If you have other questions and concerns, you should contact the IRAS for assistance immediately. They are open from 8AM to 5pm every Monday-Friday.

Leave a Reply